Motor Coverage Getting Easier to Manage Through Simple App Features

In today’s fast-paced world, managing motor insurance has become more than just a necessity; it’s a matter of convenience. As we witness a digital revolution, the traditional ways of managing car insurance are being replaced by innovative solutions. This seismic shift is powered partly by the rise of insurance apps that have streamlined the process, making it more accessible than ever. This article delves into how these apps are changing the landscape of motor coverage and why they are a boon to users.

The Evolution of Motor Insurance

Motor insurance has long been regarded as a cumbersome affair. Traditionally, procuring or renewing a policy involved endless paperwork and lengthy phone calls. The complexity was enough to drive anyone up the wall. However, the advent of technology, especially the smart car insurance app, has flipped the script. These apps are transforming how consumers engage with their motor insurance providers.

Why the Transition to Insurance Apps?

One might wonder why there has been such an emphasis on transitioning from traditional methods to digital platforms. The answer lies in convenience and efficiency. Today’s consumers demand intuitive solutions and swift services. Here are some of the reasons these apps have gained traction:

User-Friendly Interface

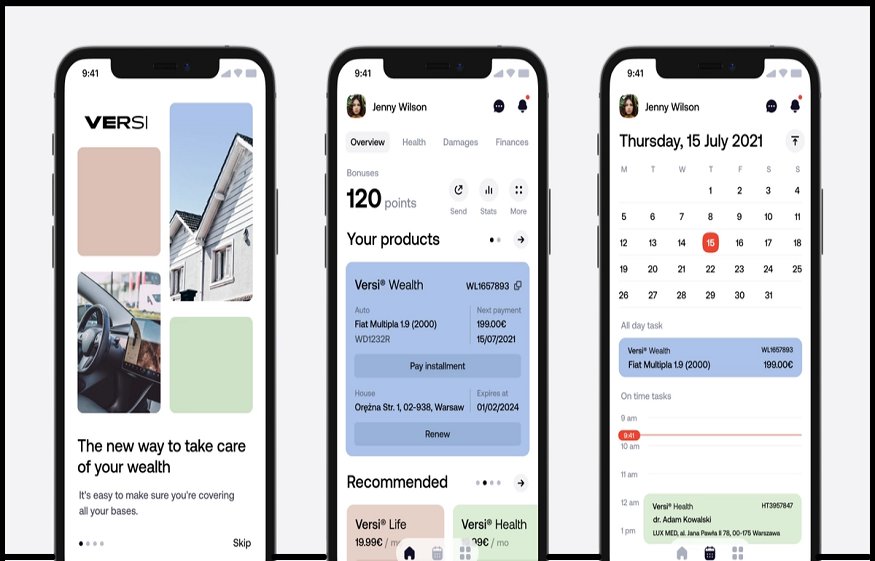

A major selling point of any successful app is a user-friendly interface. Modern insurance apps typically boast clean designs and intuitive navigation. For instance, locating your policy documents, updating your personal information, or even filing claims can be accomplished with just a few taps. It’s like having a personal assistant at your fingertips, always ready to assist.

Instant Policy Management

Gone are the days of waiting on hold to speak with a customer service representative. With a car insurance app, policyholders can renew or modify their policies instantly. This immediacy reduces the risk of lapses in coverage and ensures continuous protection. It’s akin to having a toolkit ready and within reach whenever needed.

Key Features Making Insurance Apps Indispensable

The real magic of insurance apps lies in their features, designed to enhance user experience and offer comprehensive support. Here are some standout features:

Seamless Claims Process

One of the most anxiety-inducing aspects of motor insurance is filing a claim. Traditional methods often left individuals feeling like they were jumping through hoops. Modern apps simplify this significantly. Users can upload images, view claims status in real-time, and receive updates directly through the app. Think of it as having a transparent window into an otherwise opaque process.

Personalised Recommendations

Insurance is not a one-size-fits-all model. Understanding this, many apps now offer personalised policy recommendations based on usage patterns and driving history. It’s like having a tailor who knows your style and preferences, ensuring you don’t pay for coverage you don’t need.

Integration with Telematics

Telematics technology is being increasingly integrated into these apps. By collecting data on driving habits, apps can reward safe drivers with discounts. It’s similar to how fitness apps track activity to offer health advice, except, in this case, good driving habits can directly translate into savings.

Real-World Impact: Case Studies

To truly understand the benefits of these apps, let’s look at some real-world impacts:

- Case Study 1: An insurance company in India integrated artificial intelligence into its app to predict customer needs and offer tailored insurance solutions. Policyholders could see up to a 15% reduction in their premiums when they adapted safe driving habits monitored through the app.

- Case Study 2: In a pilot project, a UK-based insurer launched an app feature that allowed users to immediately connect with a mechanic in case of a breakdown. This on-the-spot assistance improved customer satisfaction scores by 30%.

These examples highlight that real, measurable benefits come from leveraging smart features within an insurance app.

Overcoming Challenges

Despite the numerous benefits, the transition to digital platforms isn’t without challenges. Many people, especially older generations, might resist using apps due to unfamiliarity or distrust. It’s imperative that these apps are paired with robust customer education programmes to bridge the gap.

Ensuring Data Security

Security is a significant concern for any app handling sensitive information. As such, insurance companies are investing heavily in encryption technologies and secure servers to safeguard user data. It’s akin to fortifying a digital vault, ensuring that your personal information remains protected.

Simplifying Complexity

While technology can simplify many processes, there’s a risk of overwhelming users with too many features. Striking a balance between functionality and simplicity is key. Developers must continually refine their apps based on user feedback to maintain an intuitive experience.

The Future Of Motor Coverage Management

The landscape of motor coverage management is set for a continued evolution. As artificial intelligence becomes more advanced, we could see predictive analytics playing a bigger role, offering real-time policy adjustments. Imagine an app that not only manages your current needs but anticipates future ones—a virtual insurance advisor.

Moreover, as 5G technology becomes more widespread, the speed and efficiency of these apps will further enhance, offering even quicker responses and facilitating more interactive features such as augmented reality for accident assessments.

Inviting Reflection and Action

The shift towards insurance apps is undeniable, with benefits that make life easier and policies more manageable. However, this transformation requires openness and adaptability, both on the part of consumers and insurance providers.

For consumers, the move to embrace these digital tools can lead to cost savings, better coverage, and unmatched convenience. For providers, the push should be to increase trust and enhance features that resonate with user needs.

In conclusion, as we march forward in this digital age, embracing the change and reaping the benefits of advanced technology in motor coverage management is not just wise—it’s essential. If you’ve yet to explore what a car insurance app can offer, now is the time to take the plunge. Look for an app that suits your needs, pay attention to user reviews, and embark on a smoother, smarter path to managing your motor coverage.