The Role of a Financial Advisor in Investment and Wealth Management

In today’s complex financial landscape, individuals are often faced with the daunting task of managing their investments and wealth. With so many options and variables to consider, the importance of seeking professional guidance from a financial advisor cannot be overstated. A financial advisor plays a crucial role in helping clients navigate their investment goals, and wealth management needs, providing expert advice and tailored solutions to help secure their financial future.

What is a Financial Advisor?

A financial advisor is a professional who provides financial guidance and advice to individuals on how to best manage their money. These professionals are well-versed in various aspects of finance, including investment management, retirement planning, tax strategies, and estate planning. By understanding their clients’ financial goals and risk tolerance, financial advisors can develop personalized financial plans to help clients achieve their objectives.

The Importance of Wealth Management

Wealth management is a holistic approach to managing an individual’s financial resources and investments. It involves creating a comprehensive financial plan that takes into account a client’s current financial situation, long-term goals, and risk tolerance. A financial advisor plays a vital role in wealth management by helping clients make informed decisions about their investments, retirement planning, and estate planning. By leveraging their expertise and market knowledge, financial advisors can help clients build and preserve wealth over time.

Investment Management and Advisory Services

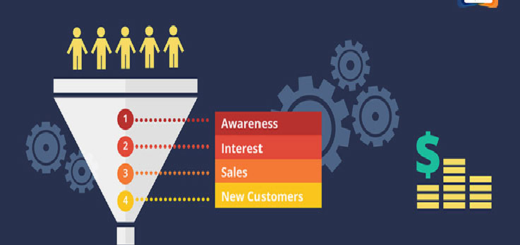

One of the key responsibilities of a financial advisor is investment management. Investment management involves creating and implementing an investment strategy tailored to a client’s financial goals and risk tolerance. Financial advisors help clients build diversified investment portfolios, monitor market trends, and adjust strategies as needed to maximize returns and mitigate risks. By providing ongoing investment counseling and advice, financial advisors can help clients navigate market fluctuations and achieve their investment objectives.

The Role of an Investment Advisor

An investment advisor is a type of financial advisor who specializes in providing investment advice to clients. These professionals are registered with regulatory authorities and have a fiduciary duty to act in their clients’ best interests. Investment advisors work closely with clients to understand their investment goals, risk tolerance, and time horizon before developing personalized investment strategies. By staying abreast of market developments and investment trends, investment advisors help clients make informed decisions about their portfolios and achieve long-term financial success.

The Benefits of Working with a Financial Advisor

Working with a financial advisor offers numerous benefits for individuals seeking to grow and preserve their wealth. Financial advisors provide expert guidance and support in navigating complex financial decisions, helping clients make informed choices that align with their financial goals and values. By developing customized financial plans, monitoring investment performance, and adjusting strategies as needed, financial advisors help clients optimize their financial outcomes and secure their financial future.

In conclusion, the role of a financial advisor in investment and wealth management is invaluable for individuals looking to achieve their financial goals and build long-term wealth. By offering expert advice, personalized financial solutions, and ongoing support, financial advisors empower clients to make informed financial decisions and navigate the complexities of the financial markets. Working with a financial advisor can help individuals achieve peace of mind knowing that their financial future is in good hands.